OP-ED: Taxes… help!

You know that feeling when someone asks you how to file taxes, and even though you’ve been doing it for years, you still hesitate to answer, afraid you’ll give wrong advice and have the person end up in jail? Yeah, me, too.

But doing your taxes is crucial, whether you are a US citizen or not.

This is not supposed to be a guide for you to do your taxes, but more like a resource guide to generally inform you about available help to do taxes.

The first step is understanding your residency status: for U.S. citizens and permanent residents, this is relatively straightforward. However, for non-residents, such as international students on an F1 visa, it can be a bit more complex.

Generally, most students and scholars who are on F, J, M, or Q visas are considered non-resident aliens for tax purposes.

Must international students file taxes? Yes. Why? Because it’s the law.

The main tax form for residents is 1040-R. This has certain laws and deductions that the form for tax non-residents (1040-NR) does not get. If you file a 1040-R as a tax non-resident, you will be penalized.

International students on J-1 or F-1 visas are automatically considered non-residents for their first five calendar years in the US, while scholars and researchers on J visas are considered non-residents for only two out of the last six calendar years while being in the US.

If you’ve been in the US for longer than those 5- or 2-year periods, the Substantial Presence Test will determine your tax residency.

As a college student, your income sources may vary. You may have income from part-time jobs, internships, scholarships, or grants. It’s essential to understand how each type of income is taxed.

If you are getting help from a tax specialist, they can guide you in preparing your taxes step by step.

Here are three options I know for obtaining assistance in preparing your taxes. Two of them are free – for residents and non-residents.

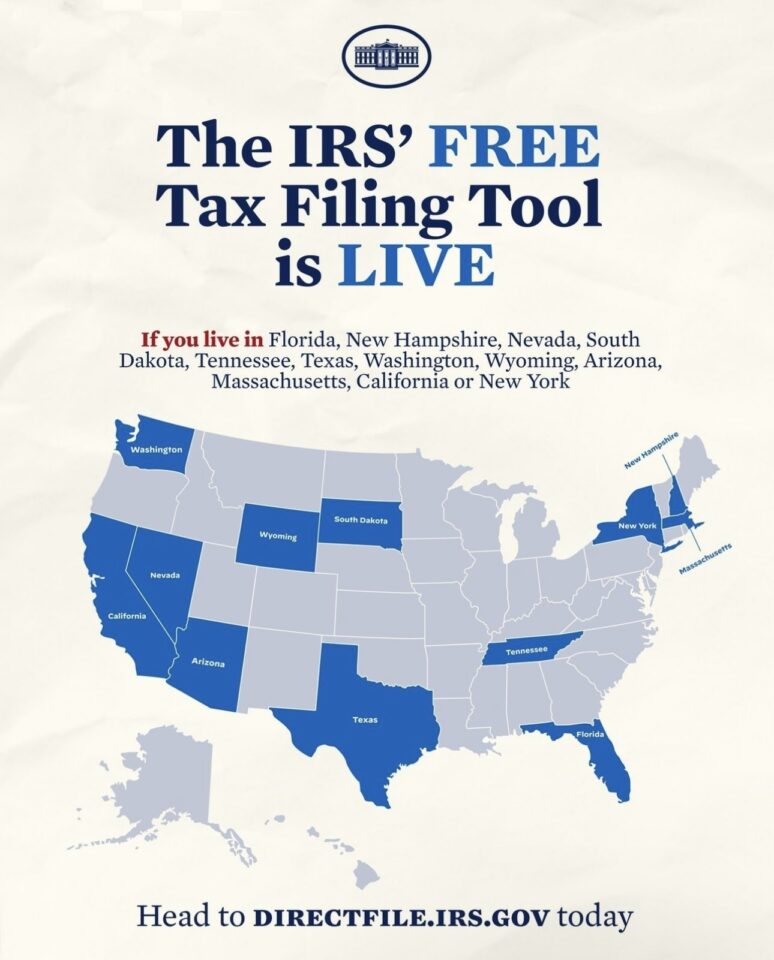

The first one is DirectFile, a new tax tool for filing federal taxes directly with the Internal Revenue System, the department that processes taxes in the US.

Because it’s very new and launched on March 12, 2024, it has few and simple tax needs, but for some, this should be enough.

They offer step-by-step guidance and live online support Monday through Friday from 7 a.m. to 5 p.m., Eastern Time.

However, for international students, this is not an option.

Secondly, there’s the service facilitated by the United Way of King County. They offer free assistance, both in-person and virtually. I have always chosen virtual assistance, in which you complete a set of basic information questions about yourself from tax preparation software and then proceed to work with a tax specialist via email, SMS, and phone calls.

For in-person sessions, they provide several locations in Seattle where you can come without booking an appointment in advance. For virtual assistance, a tax specialist will help you while you answer their questions on your situation and provide documents to prepare your tax filing.

Lastly, LewerMark, the health insurance company referred to by the International Programs department for enrolled students at Central, suggests using Sprintax. They will have free webinars for non-residents, so you can register here.

Even if you did not earn any income, if you were physically in the US on an F or J status between January 1st – December 31st, 2023, you’re obligated to file a Form 8843 with the IRS.

Meanwhile, if you earned any taxable US-sourced income, you may need to file a federal tax return with the IRS. Depending on your circumstances, you may also need to file a state tax return(s).

Scholarships and grants may be tax-free or taxable, depending on how you use the funds.

Additionally, you may be able to deduct student loan interest paid during the year, which can further reduce your taxable income.

Part-time job income is typically subject to federal and state income taxes, as well as Federal Insurance Contributions Act (FICA) taxes for Social Security and Medicare. However, if you’re an international student on an F1 visa, you may be exempt from FICA taxes.

Tax deductions and credits are also available to help offset the cost of college expenses. The most significant are the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits can help lower your tax bill.

I asked the Human Resources (HR) department at Central about my situation as an F1 visa holder who has income from jobs on campus, and they instructed me with the following, highlighting that my W4 would look different than that of residents:

Please download the W4 by following the linked instructions: https://ctclinkreferencecenter.ctclink.us/m/79746/l/1148386-ess-w-4-withholding.

International students are supposed to fill out the W4 as follows:

- Check the box for “Single or Married Filing Separately” (even if Married and filing jointly)

- Write “NRA” or “Non‐Resident Alien” under box 4C.

- Sign and Date (the form is invalid if not signed or dated).

- Once the form is completed, please attach the document to an email and send it to HR.

Again, non-residents, such as international students, must pay Federal Income Taxes, which I usually estimate to be about 10% of their total yearly income—deposited into my account from their paychecks.

Filing taxes can be tedious and exhausting, but understanding your tax obligations as a college student is essential for complying with U.S. tax laws. But once you start getting used to it, it gets easier.

By familiarizing yourself with your residency status, income sources, deductions, and credits, you can minimize your tax liability and ensure a smooth tax filing process.

Taxes don’t have to be daunting. With the proper knowledge and resources, you can navigate the tax system with confidence and ease.